SINGAPORE MYANMAR INVESTCO LIMITED

| Annual Report 2016

36

CORPORATE GOVERNANCE

REPORT

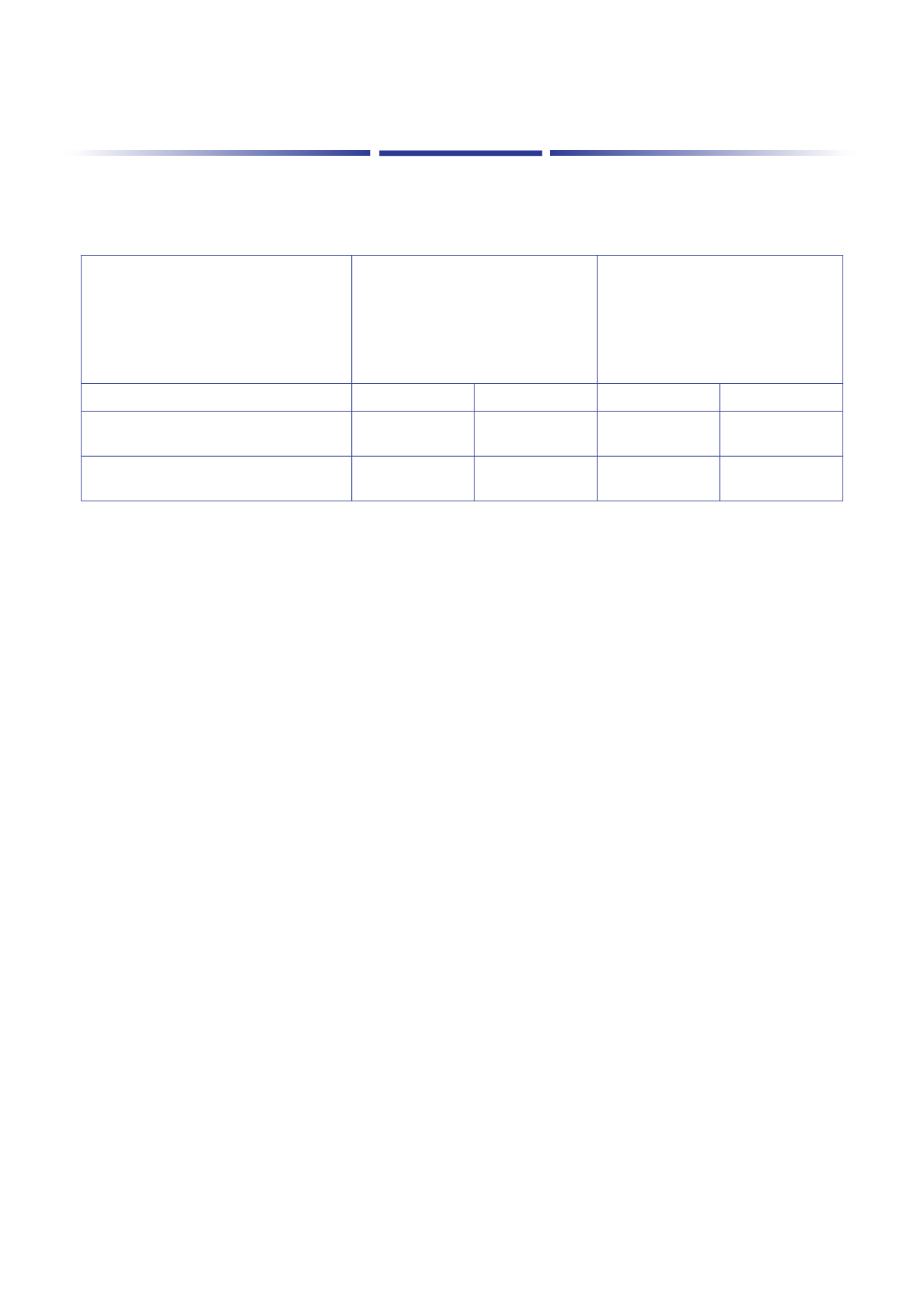

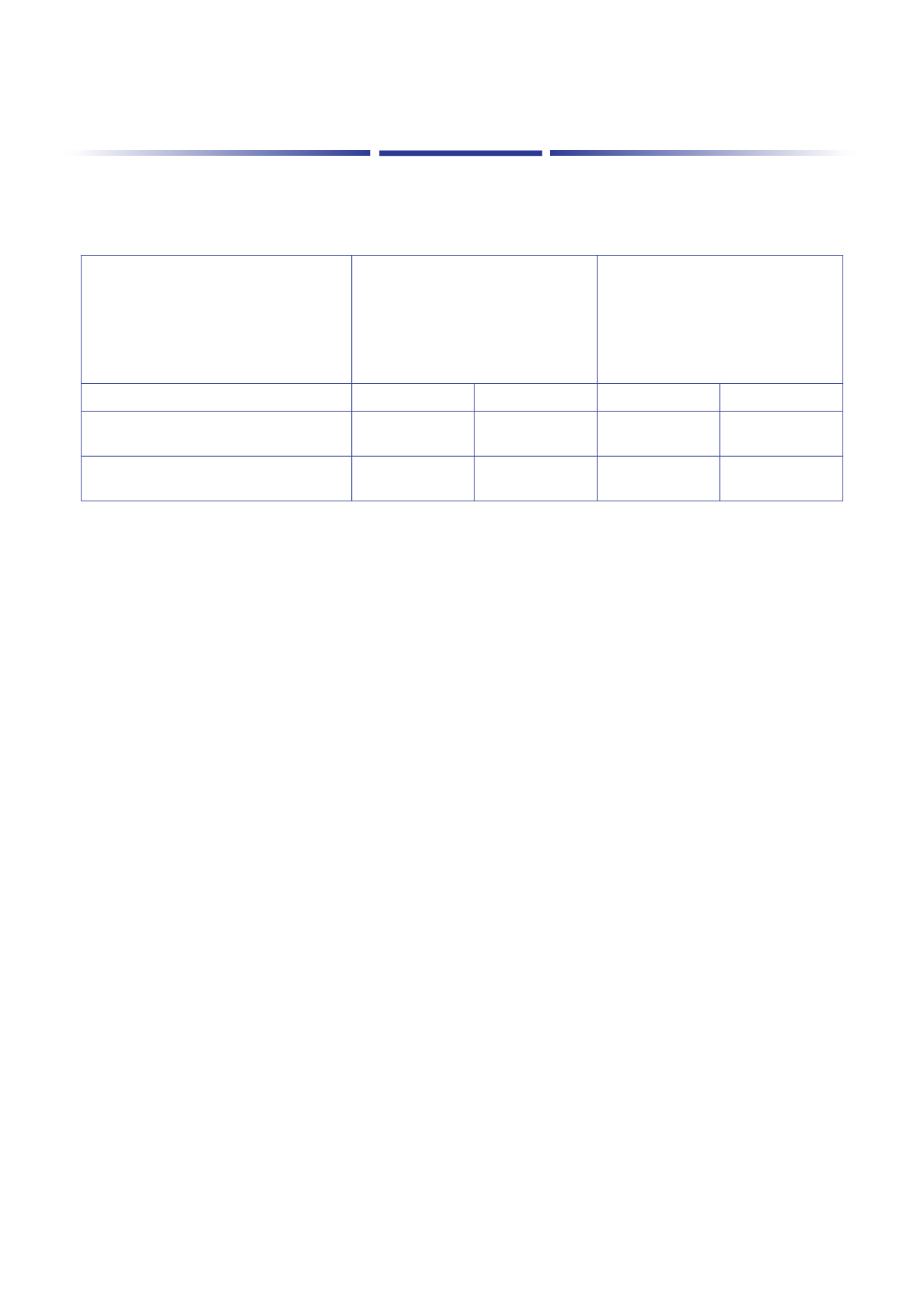

The aggregate value of interested person transactions (“IPTs”) during the reporting year was as follows:

Name of interested person

Aggregate value of all interested

person transactions conducted

during the financial year under

review (excluding transactions less

than S$100,000 and transactions

conducted under shareholders’

mandate pursuant to Rule 920)

Aggregate value of all interested

person transactions conducted

under shareholders’ mandate

pursuant to Rule 920 (excluding

transactions less than S$100,000)

FY2016

FY2015

FY2016

FY2015

Loan from Director

– Ho Kwok Wai

US$8,281,142

US$2,958,523

–

–

Loan from Director

– Mark Francis Bedingham

US$2,002,080

–

–

–

Mr Ho Kwok Wai is the Non-Executive Chairman and Controlling Shareholder of the Company who holds 64.53% of the

total issued and paid-up Shares (inclusive of both direct and deemed interests). Pursuant to a loan agreement dated 16

February 2015, Mr Ho Kwok Wai granted a loan of a total principal amount of US$10,000,000.00 to the Company at an

interest rate of 2.34% per annum, of which US$7,000,000.00 has been disbursed as at 11 February 2016. The maturity date

of the loan is the date falling 24 months from the date of the first disbursement of the loan. The interest rate for the loan

was agreed between the parties having regard to the applicable interest rate of 2.34% charged by United Overseas Bank

Limited, being the Company’s main banker, for a two-year working capital loan. The loan is unsecured.

Mr Mark Francis Bedingham is the Executive Director, President, CEO, and Shareholder of the Company who holds 3.08%

of the total issued and paid-up Shares (inclusive of both direct and deemed interests). Pursuant to a loan agreement

dated 14 January 2016, Mr Mark Francis Bedingham granted a loan of a total principal amount of US$2,000,000.00 to the

Company at an interest rate of 2.34% per annum, of which US$2,000,000.00 has been fully disbursed as at 11 February

2016. The maturity date of the loan is the date falling 24 months from the date of the first disbursement of the loan. The

interest rate for the loan was agreed between the parties having regard to the applicable interest rate of 2.34% charged

by United Overseas Bank Limited, being the Company’s main banker, for a two-year working capital loan. The loan is

unsecured.

Subsequent to 31 March 2016, the SGX-ST has granted its in-principal approval for the listing and quotation of up to

35,264,050 Debt Conversion Shares. Pursuant to the Debt Conversion Deeds, Mr Ho Kwok Wai and Mr Mark Francis

Bedingham have agreed to convert shareholders loans of US$9,073,732 for up to 35,264,050 new ordinary shares in the

capital of the Company at the issue price of S$0.36 per Debt Conversion Share.

The Company will be convening an extraordinary general meeting to seek Shareholders’ approval for the Proposed Debt

Conversion.

Subsequent to the Company’s announcement of the Proposed Debt Conversion on 11 February 2016, Mr Ho Kwok Wai

had at the Company’s request disbursed a further US$1,200,000.00 to the Company on 26 February 2016 at the same

interest rate and terms as provided in the aforesaid loan agreement, as the Company needed further funds for its

operations. The parties do not intend to convert the additional disbursement of US$1,200,000.00 into Shares.

The Company has not obtained a general mandate from shareholders for IPTs.