SINGAPORE WINDSOR HOLDINGS LIMITED

| Annual Report 2015

78

Year ended 31 March 2015

NOTES TO THE

FINANCIAL STATEMENTS

27. Financial instruments: information on financial risks (cont’d)

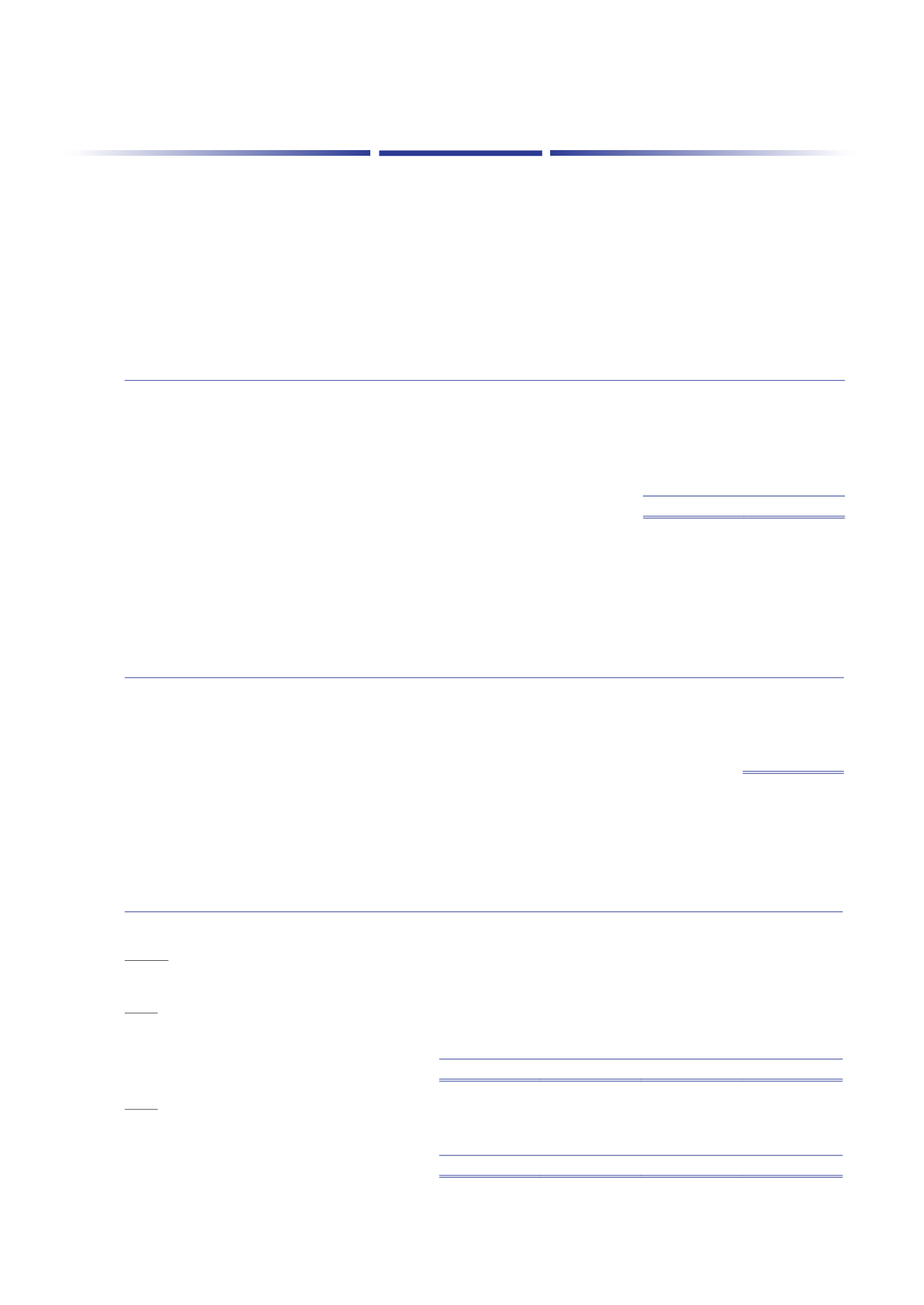

27D. Credit risk on financial assets (cont’d)

Ageing analysis of the age of trade receivable amounts that are past due as at the end of reporting year but not

impaired:

Group

2015

2014

HK$’000

HK$’000

Trade receivables:

61 to 90 days

861

12,563

91 to 150 days

1,745

6,628

Over 150 days

9,831

4,636

Total

12,437

23,827

There is no fixed maturity for the available for sale investments.

Other receivables are normally with no fixed terms and therefore there is no maturity.

Concentration of trade receivable customers as at the end of reporting year:

Group

2015

HK$’000

Top 1 customer

5,112

Top 2 customers

8,048

Top 3 customers

10,490

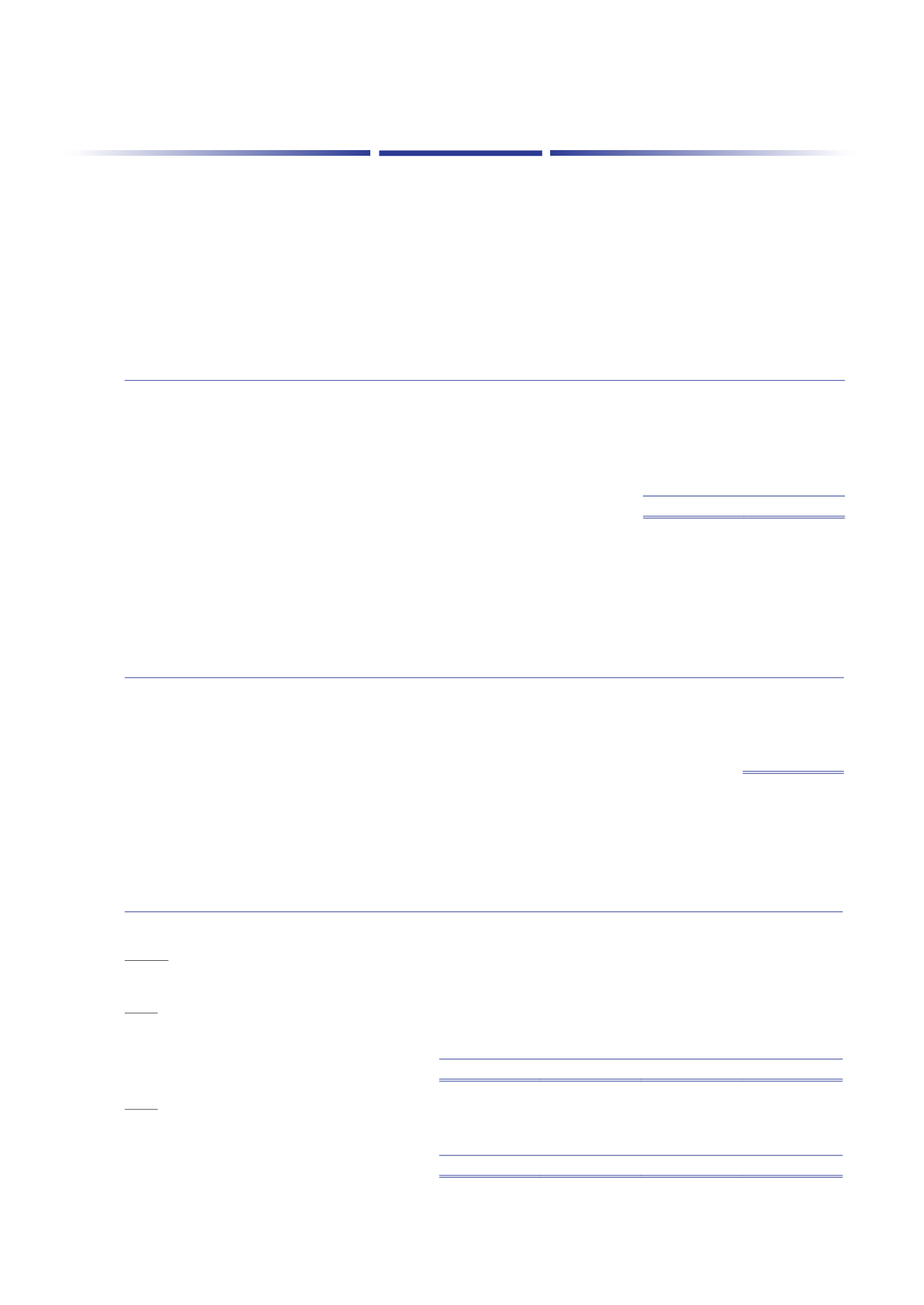

27E. Liquidity risk – financial liabilities maturity analysis

The following table analyses the non-derivative financial liabilities by remaining contractual maturity (contractual

and undiscounted cash flows):

Less than

1 year

1 – 2 years 2 – 5 years

Total

HK$’000

HK$’000

HK$’000

HK$’000

Group:

Non-derivative financial liabilities:

2015:

Gross borrowings commitments

6,124

5,650

−

11,774

Trade and other payables

21,823

23,465

−

45,288

At end of the year

27,947

29,115

−

57,062

2014:

Gross borrowings commitments

106,876

7,211

45,143

159,230

Trade and other payables

58,741

–

–

58,741

At end of the year

165,617

7,211

45,143

217,971